Data is the core factor of the digital economy, and personal data is a key element within the entire data-factor market. It is not only a focal point of data governance across countries worldwide, but also a topic closely followed by major international media. MyData has become one of the mainstream industrial models in the global personal data economy in the post-GDPR era—characterized by stringent regulation of personal data—and has now attracted widespread attention globally, from Europe and the United States to emerging market economies.

I. Background of the Conference

On December 20, 2025, following the first conference held on May 1, 2024 in Seoul, the 2rd China Korea International Seminar of MyData was successfully convened in Zhangjiang, Shanghai.

(I) Conference Theme

“People-Centered Approach: Exploring Innovative Pathways for the Factorization and Monetization of Personal Data”

Conference Objectives: To share cutting-edge global developments in personal data governance, personal data circulation, and MyData practices; to showcase the latest domestic practices in the industrial application of data factorization and data monetization; to promote China–Korea cooperation in data rights, data transactions, and trusted applications; to discuss pain points, institutional innovations, and technological pathways in China’s data factor market; and to release research outcomes related to MyData Asia or data factorization, thereby advancing the implementation of cooperative projects.

Basic Information of the Conference:

Conference Title:

The 2rd China Korea International Seminar of MyData

Date & Time:

Saturday, December 20, 2025, 13:00–18:00

Venue:

AI Innovation Center, Shanghai Zhangjiang Fintech DataPort

(No. 56 Fanchang Road, Pudong New Area),

Building 4 (North Wing), 8th Floor, Shanghai

Conference Themes:

Personal Data: Global Development and Practices of MyData

Personal Data in Korea: Explorations and Lessons Learned from MyData

Potential Applications of MyData: Personal Data in China and Emerging Market Economies

Speakers Include:

| Mr. Michael Lee | Affiliation: MyData Global |

| Professor Tae Hoon Lim | Affiliation: Korea University |

| Professor Yikun Xia | Affiliation: Nanjing University |

| Dr. Chuanwei Zou | Affiliation: Jingsu Jinke Research Institute on Digital & Technology Finance |

| Dr. Xinhai Liu | Affiliation: Beijing Credit Society |

| Professor Jidong Chen | Affiliation: Low School of Tongji University |

| Dr. Zhiqi Mao | Affiliation: Ant Group Co., Ltd |

| Mr. Pengli Wang | Affiliation: XinwuYitong |

| Dean Fu Shan | Affiliation: Hainan Fiduciary-Data Institude |

| Mr. Guangyong An | Affiliation: Professional Committee of Credit Management, China Mergers & Acquisitions Association |

Positioning of the Seminar:

A platform for experts and scholars in the digital economy from China and South Korea to exchange ideas and insights.

(II) Overview of Participation

The seminar was originally planned as a closed-door workshop with approximately 20 participants. However, due to strong interest from professionals in the field, the final attendance exceeded 50 participants. Top experts in the Korean MyData sector were present, and nearly all major domestic institutions related to personal data sent representatives. These included organizations ranging from the State Information Center to the National Data Administration; from financial information infrastructures such as payment and credit reporting systems to personal credit reporting companies; from telecommunications operators to maritime information institutions; from major technology companies such as Ant Group Co., Ltd to publicly listed data companies; from think-tank experts of the China Academy of Information and Communications Technology to grassroots leaders of local data bureaus, as well as multiple start-ups, open-source communities, and public-interest foundations. Numerous data institutions based in Shanghai also participated actively.

In addition, experts and scholars with diverse disciplinary backgrounds—including economics, information management, digital finance, law, digital technology, public administration, and artificial intelligence—attended the seminar. They came from institutions such as Antai College of Economics and Management of Shanghai Jiao Tong University, the Data Management Innovation Research Center of Nanjing University, the Low School of Tongji University, East China University of Political Science and Law, leading law firms, the China Mergers & Acquisitions Association, and the Beijing Credit Society.

II. Opening Remarks

(I) Remarks by the Host

Mr. Xiaoqiang Shen, General Manager of Shanghai Fintech DataPort Development Co., Ltd., delivered the welcome address and introduced the development of the Zhangjiang Fintech DataPort. Established in 2003, the Zhangjiang Fintech DataPort welcomed China UnionPay as its first resident project. Subsequently, a number of major financial institutions settled in the park, including Ping An Insurance, Bank of China, Bank of Communications, the Credit Reference Center of the People’s Bank of China, the Clearing Center, the Anti-Money Laundering Center, as well as many other financial institutions. Over the long term, the park has focused on key areas such as payment, clearing, credit reporting, regulation, security, and standards, and is committed to building a practice zone for financial digital transformation, a cluster for financial data enterprises, a demonstration zone for financial data applications, and a pilot zone for financial innovation and regulation.

Mr. Shen noted that, as an important component of the Zhangjiang Group, the Zhangjiang Fintech DataPort serves the overall development of Zhangjiang Science City. At present, Zhangjiang Science City covers a total area of approximately 220 square kilometers and brings together around 500,000 entrepreneurs and 24,000 technology enterprises. Looking ahead, the Fintech DataPort will continue to empower financial institutions and technology companies, and welcomes stakeholders from all sectors to jointly explore new pathways for unlocking data value in the data-driven era and to achieve coordinated development in Zhangjiang.

(II) Conference Introduction by the Domestic Initiator of MyData

Dr. Xinhai Liu, Editor-in-Chief of Data Economy Review and initiator of the conference, introduced the background and origins of The 2rd China Korea International Seminar of MyData. He noted that he has long been engaged in technical work related to artificial intelligence, machine learning, and credit reporting, and through practice has deeply experienced the institutional and real-world challenges surrounding the proper use of personal data. In 2018, while participating in legislative research on the Personal Information Protection Law and related proposals to the National People’s Congress, he further came to recognize the significant differences among regulators, academia, industry, and the international community in their understanding of personal data. This prompted him to begin systematic policy and industry research in the field of personal data.

In 2019, during his research on South Korea’s personal credit reporting reform, Dr. Liu was first introduced to the concept of “MyData.” He has since continuously tracked its global development and became one of the earliest members of MyData Global in China. He emphasized that MyData, centered on the principle of “my data, my control,” represents an important model of data governance and data economy in the post-GDPR era. South Korea’s national-level promotion of MyData has achieved notable results, generating positive impacts for consumers, start-ups, and traditional institutions alike.

Dr. Liu believes that, as the world’s largest consumer data market, China possesses abundant application scenarios and a strong technological foundation, and that MyData is expected to become a new engine driving the high-quality development of China’s data economy. In recent years, his team has continuously promoted the dissemination of MyData-related concepts in China through research, publications, and international exchanges, and has launched MyData Journal, which has generated broad influence across academia, regulatory bodies, and industry. He noted in particular that his visits last year to MyData-related institutions in South Korea and his participation this year in the MyData Global Conference in Finland were highly rewarding, and he expressed his willingness to share these international frontier experiences with participants.

III. Keynote Speeches

The keynote session of the seminar was moderated by Mr. Pengli Wang, Co-founder of XinwuYitong, one of the event organizers known for its geek-oriented style. Mr. Guangyong An, a Korea-based expert in credit reporting and data and a researcher at the Research Institute of the China Mergers & Acquisitions Association, served as the professional interpreter for the two Korean experts participating in the seminar.

(I) Michael Lee, Board Member of MyData Global: Global Progress and Practices of MyData

Mr. Michael Lee, Board Member of MyData Global (the world’s largest non-profit organization dedicated to the personal data economy, established ten years ago and having exerted certain influence on EU policies), shared the latest global progress and practical experiences of MyData at the seminar, and systematically introduced the technological frontiers of MyData in the fields of blockchain and privacy-preserving computation. Mr. Lee has long been committed to research on blockchain-based MyData services and privacy protection technologies. He currently serves as a Board Member of MyData Global, Chief Executive Officer of SNPLab Inc., and Adjunct Professor of Artificial Intelligence Technology Management at the Graduate School of Technology Management of Kyung Hee University. He has worked for more than 27 years at multinational corporations such as Samsung Electronics and Motorola, and has extensive experience in security assessment, privacy policy, and data governance.

In his speech, he reviewed that MyData originated from a “people-centered data sovereignty movement,” with the core objective of enabling individuals to truly control their data, decide how their data is used, and obtain tangible value from data circulation. He pointed out that South Korea has taken the lead in institutionalizing and implementing MyData in sectors such as finance, public services, and healthcare. However, under a government-led and industry-segmented model, structural issues have gradually emerged, including insufficient innovation momentum and limited cross-industry collaboration. The future development of MyData, he argued, should return to the essence of personal sovereignty and avoid the formation of new platform monopolies.

Mr. Lee further shared a new pathway based on an “on-device data model,” under which personal data is stored directly on users’ devices and, combined with blockchain and privacy-preserving computation technologies, enables “data not to move while usage rights move.” This approach aims to truly assetize personal data and allow it to continuously create value. He expressed his expectation to deepen cooperation with China to jointly explore MyData development models with greater practical relevance and tailored to Asian markets, and to work together to advance a people-centered future of the data economy.

(II) Tae Hoon Lim, the “Father of MyData” in Korea: Exploration and Lessons of MyData in Korea

Professor Tae Hoon Lim, Research Professor at Korea University, systematically shared Korea’s exploration experiences and practical lessons in MyData at the seminar. Professor Lim has long been engaged in research related to MyData and is the author of MyData B.L.T.S., and is widely regarded in the industry as the “Father of MyData in Korea.” He currently serves as a Research Professor at the Institute for Convergence Research of Korea University, and is also involved in data policy research and industrial support work at the Korea Data Agency. For many years, he has provided consulting and services to governments and enterprises in the areas of data governance, data circulation, and industrial applications. His research fields cover MyData, data governance, data transactions, data value assessment, as well as the construction of data standards and quality systems.

Professor Lim pointed out that the rapid implementation of MyData in Korea has benefited from the BLTS ecosystem framework that he proposed and promoted, which advances data systems and industrial development in a coordinated manner across four dimensions: Business, Legal, Technology, and Society. This framework has provided a systematic methodology for the cross-industry promotion of MyData. At the practical level, Korea’s MyData has expanded from the financial sector to multiple scenarios including public services, healthcare, education, and transportation. Individuals are able to download, transfer, and use their own data through standardized APIs, enabling cross-institutional data circulation and service collaboration, such as the sharing of medical records across hospitals, the digitization of academic credentials, and one-stop aggregation of financial accounts.

He emphasized that the right to data portability and the individual’s right to independently decide on the use of personal data have been explicitly incorporated into Korea’s legal system, forming the core foundation for the operation of the MyData framework. However, Professor Lim also noted that Korea’s practice has revealed challenges in areas such as standards coordination, cross-industry collaboration, and public awareness. Looking ahead, he argued that the success of MyData depends not only on technological capabilities, but also on the formation of social consensus and the establishment of mandatory unified standards. He advised that, in advancing institutional innovation for personal data, China should focus on standard systems, legal authorization mechanisms, and shifts in multi-stakeholder perceptions, in order to truly achieve the goal of “returning data to individuals.”

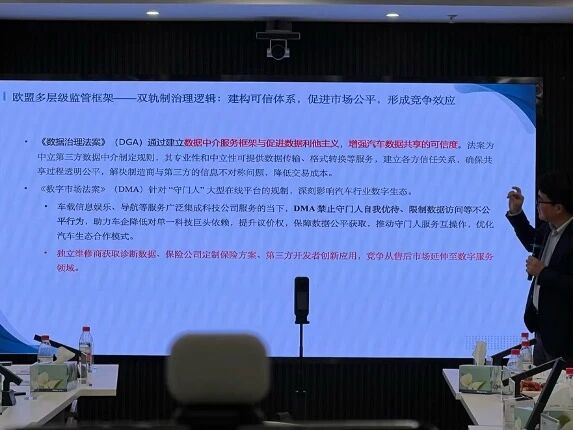

(III) Jidong Chen, Tongji University: Personal Data Spaces and Their Computational Constraints in the Construction of the Data Factor Market

Professor Jidong Chen from the Low School of Tongji University pointed out that the core of future governance will no longer focus solely on data itself, but rather on the concept that “circulation is computation,” requiring the replacement of silo-based system thinking with spatial collaboration. European cases such as Gaia-X and Catena-X demonstrate that data spaces have become an important foundation for promoting industrial collaboration and value-chain innovation. Meanwhile, legal frameworks such as the Data Act and the Data Governance Act are reshaping the landscape of data rights, encouraging enterprises to shift from being “data monopolists” to “data coordinators.” Technical rules and legal rules together constitute a new logic of cooperation and justice, providing important insights for the future circulation of data factors in China.

(IV) Xinhai Liu, Beijing Credit Society: Applications of MyData in China and Emerging Market Economies

Dr. Xinhai Liu, Vice President of the Beijing Credit Society, shared key takeaways from the 2025 MyData Global Conference and expressed the view that MyData has broader prospects in China and emerging market economies. He proposed the establishment of MyData Asia to leverage global resource allocation and work together with emerging market countries to explore the future of the digital economy.

Dr. Liu pointed out that China possesses the world’s largest personal data infrastructure: platforms such as payments, credit reporting, medical insurance, big technology companies, and telecommunications operators each reach more than one billion users. However, the realization of data dividends faces an “impossible trinity” dilemma—protection pressure, innovation stagnation, and difficulties in data sharing. He emphasized that in the era of artificial intelligence, the real challenge is not data application itself, but rather “whether we trust whom we hand our data over to.” Therefore, it is necessary to build “digital fiduciaries” with ethical and institutional safeguards, enabling data to generate inclusive value while respecting privacy.

He noted that the MyData model offers a solution: through data portability, proactive personal AI assistants, and on-device computing technologies, data is no longer a moat for giants, but becomes common soil for innovation. He called for joint exploration of future digital economy innovation strategies in data governance for emerging market economies worldwide—“using China’s experience and exploration to provide solutions for the world.”

IV. Thematic Presentations of the Seminar

(I) Pengli Wang, XinwuYitong: Personal Data Driving Consumption

Mr. Pengli Wang, Founder of XinwuYitong, stated that Chinese-style modernization requires the parallel advancement of spiritual civilization and material civilization. He emphasized that the future digital economy must be built upon trusted personal data spaces, enabling data to be genuinely transformed into a driver of economic growth. He proposed establishing an innovative pilot zone in Shanghai for “personal data–driven consumption” through compliant digital infrastructure based on Web 3.0, forming a consumption incentive model with data traceability and closed-loop fiscal management via mechanisms such as DID digital identities and blockchain-based cultural and tourism vouchers.

He noted that culture and tourism represent the optimal entry point linking consumption tax reform, fiscal structure adjustment, and the practical implementation of the digital economy, and that China has a full opportunity to lead a new global paradigm of the data economy through institutional innovation.

(II) Yikun Xia, Nanjing University: The Current State of Personal Data Governance Research at Home and Abroad

Professor Yikun Xia from the Data Management Innovation Research Center of Nanjing University systematically introduced global development trends in personal data governance. She pointed out that research on personal data has shifted from the traditional paradigm of “privacy protection” to that of “data governance,” with the governance logic evolving from an individual-informed-consent–centered approach toward collaborative governance involving multiple stakeholders and trusted third-party mechanisms. In this context, models such as MyData, data trusts, and data banks have become focal points of international exploration.

Professor Xia emphasized that China must seek an institutional balance between security and development. By innovating governance frameworks, China can address challenges such as insufficient clarification of data rights, conflicts in cross-border rules, and new types of privacy risks brought about by artificial intelligence, thereby building a future governance system that both protects individual rights and unlocks data value.

(III) Chuanwei Zou, Jingsu Jinke Research Institute on Digital & Technology Finance: The Architecture of the Personal Data Factor Market

Dr. Chuanwei Zou, President of the Jingsu Jinke Research Institute on Digital & Technology Finance and a well-known scholar in financial technology research, systematically elaborated on the key elements for building a personal data factor market. He pointed out that commercial practices in the digital economy have fully demonstrated the significant monetization value of personal data, while also giving rise to structural problems such as privacy breaches, market imbalances, and information silos. Therefore, the effective circulation of personal data must be based on a clear data property rights regime and a robust security governance framework.

Dr. Zou emphasized that institutions matter more than technology. For data factors to participate in resource allocation, it is necessary to define the boundaries of rights related to the “holding–processing–operation” of personal data and to form fair prices through market mechanisms. He proposed that China should draw lessons from experiences such as open banking, Korea’s MyData, and India Stack. However, he stressed that ordinary individuals are not suited to directly enter the personal data factor market; instead, data aggregation, processing, and agency transactions should be carried out through data trusts, information banks, and professional brokers, with individuals benefiting through revenue return mechanisms.

He concluded that the real driving force behind market formation lies in safeguarding individual rights and incentivizing data controllers to change their behavior, rather than directly regulating and transforming platforms.

(IV) Zhiqi Mao, Ant Group Co., Ltd.: Reflections on the Personal Credit Economy

Dr. Zhiqi Mao, Senior Research Expert at Ant Group Co., Ltd, delivered a keynote speech on “Reflections on the Personal Credit Economy,” proposing that the future construction of China’s credit system will enter a new stage centered on “personal credit assets.” She noted that the personal credit economy represents a new form of economy in which personal credit data serves as the core factor and individuals are the primary rights holders. Through the circulation of data factors and the development of credit systems, it provides credit support for individuals, financial institutions, and enterprises across financing, consumption, transactions, and public social services.

Dr. Mao emphasized that a socialist market economy is essentially a credit-based economy and a rule-of-law-based economy, and that the new credit economy should evolve along three major directions. First, the concretization of personal credit, enabling credit to be “visible and usable” in everyday life scenarios. Second, government participation and utilization in personal credit, providing foundational infrastructure through institutional safeguards and public credit platforms. Third, the industrialized operation of credit, forming market mechanisms in which product systems and operational systems develop in parallel.

(V) Shanli Zhang, Shandong University: Consumer Reporting Companies in Vertical Consumption Scenarios—Implications for China’s Data Monetization Path

Mr. Shanli Zhang, Ph.D. candidate at the Law School of Shandong University, delivered a keynote speech entitled Consumer Reporting Companies in Vertical Consumption Scenarios: Implications for China’s Data Monetization. He pointed out that, in addition to traditional credit reporting agencies, an important pillar of the U.S. data economy lies in vertical consumer reporting companies that are deeply embedded in consumption and industrial value chains. These institutions primarily serve B2B clients and, across specific scenarios such as housing rentals, employment, medical billing, telecommunications billing, and vehicle valuation, provide risk identification and price formation capabilities through data processing, thereby achieving a truly commercial closed loop.

He emphasized that current discussions on data factorization in China focus more on institutions and regulation, but what ultimately determines the success of monetization is “who can transform data into decision-making capabilities and persuade enterprises to pay for risk reduction or price formation.” Therefore, as China advances the development of personal data markets, data trusts, and information banks, it should simultaneously deploy industry-specific consumer reporting institutions and, through trusted data agency mechanisms, ensure the return of benefits to individuals—so that data is not merely “seen,” but can truly be “realized.”

Dr. Fu Shan, President of the Hainan Fiduciary-Data Institude, shared new trends in legislation related to the digital economy and digital finance.

During the open discussion session, Mr. Chunxue Xu, Director of the Public Service Department of State Information Center; Professor Yongguo Xu from the Antai College of Economics and Management of Shanghai Jiao Tong University; Ms. Xiaoyan Ke from the China Telecom Research Institute; Mr. Li Chen, Deputy Director of the Hechuan District Data Bureau of Chongqing Municipality; and Mr. Xin Wang, Vice President of Weiyan Technology, respectively took the floor to share their perspectives on personal data as well as their reflections on participating in the seminar.

After the formal seminar concluded, sponsored by XinwuYitong, Chinese and international participants proceeded together to the Pujiang Dragon Boat Night Banquet, where they continued discussions on the data economy.

V. Release of Seminar Outcomes

This seminar released three annual outcome reports and shared two new works by participating guests. Other outcomes, including additional presentations by seminar participants, will be gradually compiled and released to the public at a later stage.

(I) Release of the Chinese Translation of MyData B.L.T.S. (Chinese Title: A New Engine of the Digital Economy—Building the MyData Ecosystem)

This is a professional book on the MyData business model and ecosystem development. The author team includes Professor Tae Hoon Lim from Korea University and other scholars with profound research foundations in the field of MyData. The book provides an in-depth exploration of MyData as an emerging global data economy model, with a particular focus on its business logic, legal frameworks, technological pathways, and social impacts in the post-GDPR era. MyData aims to be people-centered, empowering individuals with self-determination over their own data while promoting innovation in the digital economy, and has been successfully implemented in Korea with remarkable results.

The book elaborates in detail on how to build a healthy data ecosystem through MyData, supporting the circulation of personal data and trust-based innovative services. Its content covers MyData from multiple perspectives, including legal, technological, service-related, and social impacts, providing valuable practical experience and theoretical foundations for practitioners in the fields of global data governance and the data economy.

Since its initial release in 2022, the book has attracted widespread attention in Korea and globally. To promote its dissemination in the Chinese market, the translation team is composed of well-known domestic data experts who, in combination with the characteristics of the Chinese market, strive to translate the concepts and applications of MyData into practical implementation, thereby advancing data factorization and the development of the personal data economy in China. The book is scheduled for publication in the first half of 2026.

(II) MyData Annual Report (to Be Released Upon Authorization from MyData Global)

The core of this report centers on MyData, a people-centered personal data management model. Based on the MyData Global Conference held in September 2025 in Finland, the report explores how to balance data protection, data utilization, and economic value creation in the context of artificial intelligence and increasingly stringent global regulation. The conference brought together internationally renowned experts in the fields of data governance, law, and technology. The conference content mainly covered four interrelated areas:

(1) Governance, Law, and Policy;

(2) Technology, Interoperability, and Data Spaces;

(3) AI and Personal Agents;

(4) Sectoral Applications and Emerging Markets.

The MyData concept aims to build a fair, sustainable, and prosperous digital society. Its core lies in empowering individuals with control over their personal data, enabling them to acquire knowledge, make informed decisions, and interact effectively with other individuals and organizations. This concept proposes a set of principles and three major paradigm shifts, has been translated into more than a dozen languages, and has been endorsed by nearly 2,000 individuals and organizations.

(III) Release of the Report Research on Innovative Models for the Development and Utilization of Global Personal Data

This report was jointly developed by the China Telecom Research Institute and Haiyang Jinzhi Data Technology (Beijing) Co., Ltd.. The report aims to explore innovative models for the development and utilization of personal data on a global scale, analyzing their concepts, current development status, characteristics, outcomes, and the challenges they face. It selects several representative models for in-depth study, including personal credit reporting, professional consumer reporting companies, data brokers, data trusts, and open banking, and also examines data practices in emerging market economies as well as data models of three major large technology platforms. In addition, the report places particular emphasis on introducing Korea’s MyData model, analyzing its characteristics and its reference value and implications for China. Through an examination of these models, the report seeks to provide useful insights on how to strike a balance between protecting personal privacy, promoting data-driven innovation, and achieving fair competition.

(IV) MyData and Data Sovereignty in the Age of AI

A work by Mr. Michael Lee, Board Member of MyData Global:

MyData and Data Sovereignty in the Age of AI

Overview:

The era of data sovereignty has arrived, and the world is transitioning toward a data-driven society. From the perspectives of big data and personal data, this book explores issues related to data ownership. Innovative services that integrate technologies such as blockchain, virtual reality/extended reality (VR/XR), and artificial intelligence (AI) are emerging one after another; however, what ultimately drives these innovative services is personal data.

Accordingly, the ownership, scope, and modes of use of data are also undergoing transformation. Data ownership is shifting from centralized to decentralized, from corporate ownership to individual ownership, and from big-data-based approaches to personal-data-based approaches.

From the perspectives of data sovereignty and the GDPR, the book elaborates on “MyData” and the changes it is expected to bring, and provides an in-depth discussion of the impact of artificial intelligence on “MyData.” The author proposes a people-centered and practically feasible implementation approach to “MyData,” and, in particular, puts forward a technical solution for the utilization of personal data based on data sovereignty.

In addition to policy discussions related to data sovereignty and personal data, the book also outlines research on data technology applications. It helps deepen the understanding of technological, policy, and market developments related to MyData.

(V) A New Interpretation of Data

Authored by Mr. Li Chen, Deputy Director of the Data Bureau of Hechuan District, Chongqing Municipality.

A New Interpretation of Data advances the view that the state should build a universal network identity account for all users that is applicable across all industries, and that this account should be controlled to the greatest possible extent by the users themselves. Under overall national coordination, users would thereby regain data rights that allow them to engage in equal dialogue with platforms. Unlike the decentralization perspective of Web3 (the third generation of the Internet, a decentralized network built on blockchain technology), the book starts from the interrelated logic of “people, data, and time,” arguing for the establishment of a time-element–centered data network ecosystem that is “based on a national user management system, with users’ autonomous choice over the time traces of their data activities as the core.”

Using the foundational element of account existence—the “account”—as an entry point, the book analyzes, explains, and demonstrates, from the perspectives of current problems in data transformation, background logic, and response strategies, the necessity, urgency, and feasibility of building time-based accounts that take the time of individuals’ data activities as the sole reference element. When all data information associated with an individual is first linked to the user through a unique, time-based account, then all data generated by human behavior can be primarily controlled by the individual who has expended the time to perform those activities. In this way, people can truly feel secure in digitizing all activity behaviors and interacting—through digital twins—with others, with society, and with the past and the future.

Subsequently, a series of evolutions may gradually be realized, including the creation of a unique digital portal for individuals in cyberspace, the logical attribution of data property rights to users’ time traces, the controllable trading of data assets that become uniquely locked due to changes in time traces, and integrated sanctions against accounts involved in digital illegal activities. Under account rules that are controllable by users themselves, platforms’ practices of leveraging the overwhelming advantages of account agreements to obtain improper benefits will become unsustainable, prompting a shift toward better services and innovation.

VI. Organizers of the Seminar

Organizers:

Beijing Credit Society

Data Economy Review & MyData China

Shanghai Fintech DataPort Development Co., Ltd.

XinwuYitong Digital Technology (Shanghai) Co., Ltd.

Co-organizers:

Haiyang Jinzhi Data Technology (Beijing) Co., Ltd.

Professional Committee of Credit Management, China Mergers & Acquisitions Association

Special thanks are extended to the conference staff from the Fintech DataPort, XinwuYitong, and Haiyang Jinzhi for their support and contributions.

VII. Next Steps

The seminar also discussed preparations for MyData Asia. On the one hand, it aims to deepen domestic exchanges and discussions and promote collaboration among industry, academia, and research institutions; on the other hand, it seeks to bring together top global experts and industry organizations, absorb and draw upon international practical experience, and explore solutions for the monetization of personal data.

Personal data concerns the digital future of China’s 1.4 billion consumers and, from a global perspective, is closely linked to the digital dividends of 8 billion people worldwide. Data Economy Review will continue to build China’s MyData community by bringing together industry forces through professional exploration, running the MyData Journal effectively, and providing professional services such as timely dissemination of the latest global developments, sharing member information, integrating resources, and facilitating seminars and exchanges, in order to jointly explore innovative development pathways for China’s personal data economy.