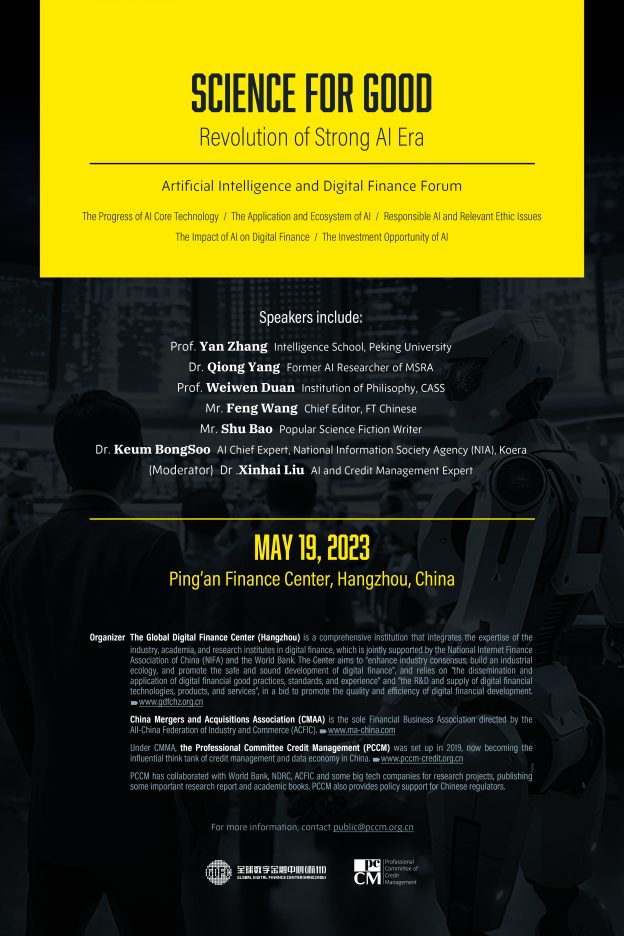

On May 19th, the seminar on artificial intelligence and digital finance “Technology for Good: Wave of Change in Strong AI Era” jointly organized by the GDFC and the CMAA was successfully held in Hangzhou. More than 20 experts and scholars from domestic and foreign research institutions, universities, industry associations, financial media, and relevant institutions attended the conference online or offline, and conducted in-depth exchanges and discussions on the technology, application, morality and ethics, and impact of AI.

In terms of the progress of core technology development of AI, experts illustrated the progress of core technology development of AI represented by ChatGPT. As a natural language processing tool driven by artificial intelligence technology, ChatGPT, with its advantages as a transformer, surpasses the traditional Convolutional Neural Network, optimizes model structure and training efficiency, etc. Through pretraining and reinforceed learning, ChatGPT manages to conduct dialogue and write articles after it succeeded in communicating with human. The success of a series of large models such as ChatGPT indicates that models have the ability to emerge, whereas only when the model and data both cross the threshold and undergo sufficient training can scale effects occur, which unleashes the models’ emergence ability to generate strong capabilities and massive knowledge. In this process, more attention needs to be paid to data quality compared with model construction, and users ought to avoid excessive parameterization while strengthen data application to ultimately improve the overall effectiveness of models.

When it comes to the application direction and ecological environment of AI in the future, experts pointed out that with the gradual expansion of models and data, AI technology will gradually develop towards multimodality and specialization in the future. The development of current AI models will promote a new round of generative AI applications. Through multiple rounds of dialogue, AI systems generate feedbacks by following the process of problem comprehension, problem retrieve, and answer generation. In the future, AI technology will have significant impacts on areas such as psychological education, student management, medical services, banking, copywriting, etc. Meanwhile, as AI technology continues to deepen its integration into human life, guiding AI towards a right direction becomes particularly crucial. In order to achieve the goal of AI being virtuous, the primary factor is to ensure that the input data itself is ethical. We need to prioritize fundamental core elements and principles as an assessment standard to achieve a harmonious relationship between AI and humanity.

In terms of the ethical issues of AI, experts pointed out that the root of the ethical issues of information technology is that Moore’s Law of information technology is much faster than the development of social and cultural systems. As emerging technologies such as artificial intelligence benefit mankind, the corresponding ethical governance system should evolve together with technological progress. At the same time, since the boundary between artificial intelligence and human intelligence has become blurred, and it carried out a large number of human-machine value alignment engineering to make machine goals conform to human intentions, plus its innovation and influence are highly uncertain, we should promote top-level legal system design, technology ethics research and publicity, promote open source innovation, build cooperative research and open source innovation platforms and develop a series of testing tools to conduct quantitative testing of its security and ethical issues so that we can build a relatively perfect technology ethics governance system.

In terms of the impact of AI on the financial industry, experts pointed out that making use of the effect of computing power can improve the operational efficiency of the financial industry. We could exert extreme computing power to solve instantaneous computing problems of high-frequency trading, and we can also exert super computing power to support system engineering such as large model training and financial complex modeling. Specifically, first, the scenes that are extremely sensitive to instantaneous calculation speed. They can be improved by computer architecture level optimization, precomputation, software to hardware, and incremental calculation of complex indicators of real-time data to improve real-time computing speed. The second is the field of computing power for super-scale complex computing, it can optimize the atomic computing efficiency of the application layer, and optimize the atomic computing of data structures, algorithms and compilers. In terms of computing power allocation optimization at the scheduling layer, all kinds of constraints should be balanced, and computing power scheduling optimization should be done in terms of network delay, data communication efficiency, node processing capacity, atomic computing processing time budget and task turbulence.

In respect of AI investment hotspots, experts pointed out that AI plays a role in reducing costs and increasing efficiency in related industries, since it accelerates the commercial implementation of large models, promotes their commercial realization, and creates more opportunities for industry development. At the same time, the comprehensive nature of AI information retrieval will expand its scope of application in investment, gradually penetrate from high-frequency investment to low-frequency investment, and continuously expand its application value.